|

|

|

|

|

|

|

|

|

|

|

|

|

|

Régions du Québec |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Temas |  |

|

|

|

|

|

|

|

|

|

|

|

Enron Style Corporate Crime and Privatization (Part III)

The U.S. Security and Exchange Commission (SEC) is also looking into how AOL Time Warner, the massive internet and media corporation, generated revenue through a number of unusual transactions, including shifting revenue between divisions and and selling advertising for eBay and then accounting for them as their own revenue...

Other cases of USCSI members connected to corporate scandals:

Merrill Lynch - the giant of the investment and brokerage world, is another of the corporations which has been linked to the scandals at Enron.

The New York Times reported that Merrill Lynch made a sham energy deal worth $60 million with Enron in December 1999 which, according to former Enron executives who were involved in the transactions, was 'intended to inflate Enron's profits and drive up its stock price.' The deal was predetermined to be cancelled after Enron booked its profits, and eventually it was. For its role, Merrill Lynch received $8 million. Merrill Lynch was also investigated for tailoring stock research to win investment bank business. It ultimately agreed to a whopping $100 million settlement with the New York State Attorney General.

AOL Time Warner

The U.S. Security and Exchange Commission (SEC) is also looking into how AOL Time Warner, the massive internet and media corporation, generated revenue through a number of unusual transactions, including shifting revenue between divisions and and selling advertising for eBay and then accounting for them as their own revenue. It also has come to light that the biggest chunk of AOL Time Warner's revenue under investigation was from deals with WorldCom who we all remember as last summer's corporate fraud superstar.

III. Privatization Engines: USCSI Members and the Privatization of Public Services

With privatization of public services as a key corporate goal of trade and investment agreements such as the FTAA and the WTO, it is not surprising that a number of USCSI members make a great living off of such privatization, and many of them surely joined the Coalition for just that reason, to promote further private access to public services around the world through the legal mechanisms of various trade agreements. Beyond criticisms of the very concept of commodification and corporate privatization of essential services, there have been more than a few problem cases stemming from this privatization which, despite the rhetoric of big business, show the true costs and losses from privatization of public services. A couple of the Coalition companies most involved in this privatization are Accenture and Vivendi Universal:

Accenture-

This business consulting company, which broke away from Andersen in 1999, is currently a key consultant and receiver of government outsourcing contracts which are often the first step in the process of the complete privatization of a public service. Accenture is a major player in the provision of long term welfare and social services outsourcing contracts and has recently become more involved in the privatization of parts of publicly run electrical utilities, having been offered a highly scrutinized contract for privatization of selected functions of BC Hydro, the publicly run electricity company in British Columbia. Beyond basic questions of the loss of public control over essential services, Accenture's efforts in government outsourcing have often been very expensive and/or of poor quality. There is good reason to question Accenture's track record in outsourcing of government services.

Ohio is just one example. Accenture was contracted to set up the states welfare reform program and the Ohio Works job matching service computer program and website (called ServiceLink). Both contracts experienced problems, including the website kicking users off shortly after they signed on, demanding excessive personal information, and the site not allowing job searchers to browse job listings. As reported in Dayton Daily News report from March 12th, 2001, these problems led to the reinstatement of the old-job matching system, Ohio JobNet.

Regarding cost and accountability, the contracts were filled with problems such as Accenture billing the state up to $450/hour per manager. According to a scathing report from the Ohio Inspector General, work done by Cochoran public relations to convince the public of the necessity of Accenture's services was marked up by 63%, costing taxpayers $67,300. As well, taxpayers paid up to $93,750 a month for coffee, lunches, California hotel rooms, office furniture, office rental, carpeting, and a husband for rent repair service

In the late 1990s, Arnold Tompkins, then welfare director of Ohio, awarded nearly $26 million in unbid contracts to Accenture. Soon after this award, Tompkins left public office and was given a $10,000 a month contract from Accenture. The largest of the contracts he signed with Accenture ($16.1 million) was approved less than a month before he left office and was done over the objections of his whole contractual review committee, which said the contract was too expensive and had not been competitively bid. The Ohio Inspector General recommended that Tompkins, and Donna Givens, a consultant who was "'instrumental' in facilitating the unbid contracts", both be charged criminally for this steering of contracts for Accenture. Ohio's state's inspector general Thomas Charles did ultimately charge Tompkins with improper steering of contracts to set up work for himself after leaving office and conflict of interest.

In November 2001, these ended in a slap in the wrist for the guilty Tompkins because though he was deemed guilty, he received a sentence of only 300 hours of service to develop a plan to integrate county based law enforcement computer systems. [Tompkins could have faced over 25 years in jail with a $50,000 fine, plus restitution to the state] This is all he received as punishment for blatantly attempting to make private gain, through his Accenture connections, from the public service. It appears likely, at least in part, that Accenture did indeed gain the unbid contracts because of its connection to Tompkins. But while the right connections certainly seem to have helped Accenture secure this contract, Accenture was ultimately unable to fulfill this outsourcing contract, leaving the people of Ohio to be the big losers in this wasteful private outsourcing scheme.

[For more information on Accenture's dubious track record, click here]

Vivendi Universal-

Vivendi Universal, through its Gnrale des Eaux and US Filter divisions, is one of the world's largest water and wastewater privatizers around the world, often with the support of the World Bank or the various other development banks. It has contracts to run the water system in cities and regions around the world, in places as diverse as Indianapolis, Tangiers, Prague, Nairobi, Bucharest and Moncton, New Brunswick. After purchasing U.S. Filter in May 1999, Vivendi Universal became the largest water and wastewater company in the U.S. market, with contracts in municipalities in various states. And Vivendi, like many other water corporations, has a spotty history in many of its privatization projects, with costs rising in numerous cases and many examples of poor service.

Having greatly overstretched in its acquisitions during the term of former CEO Jean Marie Messier, Vivendi Universal is now in serious trouble financially and possibly legally, as its share price has recently collapsed, its has begun a fire sale of assets, and both French and U.S. regulators have set up formal inquiries looking into whether the company issued misleading statements on its financial condition during Messier's tenure. As part of the investigation, Vivendi's offices in France were raided in December 2002, as were the homes of Messier and former board member Marc Vienot. Like Enron before it, Vivendi Universal has recently ended its long-time membership in the USCSI. It is unknown if this was Vivendi's choice or if the USCSI wants to distance itself from Vivendi's recent financial and legal troubles.

Looking specifically at questionable privatization contracts, two examples are Vivendi Universal's dealings in Naroibi, Kenya and in the island of Puerto Rico:

Vivendi Universals joint venture to manage the water billing and revenue system for Nairobi became the subject of a major public controversy. It was reported in the East African in August 2000 that Sereuca Space (made up of Vivendis subsidiary Gnrale des Eaux and Israels Tandiran Information Systems) was initially not willing to put its money into costly water service infrastructure stating that it will not invest a single cent in new water reservoirs or distribution systems during the ten years the contract will be in force." Instead, the company decided it would direct its investments into installing a new billing system at City Hall, reaping a 14.9 per cent profit off of the $169 million US] collected over the period.

In response to the widespread public criticism of the proposed project, Vivendi said later it would invest another $150 million in expansion, repair, and maintenance to minimize water loss. In August 2001, however, the Kenyan government announced that it was suspending the water billing project until the World Bank had completed a 'privatization option study'.

Vivendis management of Puerto Ricos water authority, PRASA, through its subsidiary Compania de Aguas, was strongly criticized by a Puerto Rican government report in August 1999 for failing to adequately maintain and repair the states aqueducts and sewers. According to Interpress news agency, The Puerto Rico Office of the Comptroller [Contralor] issued an extremely critical report on the PRASA-Compania de Aguas contract. The document lists numerous faults, including deficiencies in the maintenance, repair, administration and operation of aqueducts and sewers, and required financial reports that were either late or not submitted at all. The Interpress account of the comptrollers report went on to say, Citizens asking for help get no answers, and some customers say that they do not receive water, but always receive their bills on time, charging them for water they never get. A local weekly newspaper published reports of PRASA work crews who did not know where to look for the aqueducts and valves that they were supposed to work on. Whats more, the 1999 comptrollers report showed that under private administration, PRASAs operational deficit has kept increasing and has now reached US $241 million. As a result, the Government Development Bank (Banco Gubernamental de Fomento) has had to step in several times to provide emergency funding.

In May 2001, the Puerto Rico Office of the Comptroller issued another report about PRASAs performance, identifying 3,181 deficiencies in the administration, operation, and maintenance of the water infrastructure. Among these, the Comptroller reports that PRASAs operating losses had increased from US $241 million in August 1999 to US $695 million in May 2001, and that the agency had not collected US $165 million in bills. According to Comptroller Manuel Diaz-Saldaa, the privatization has been a bad business deal for the people of Puerto Rico. We cannot keep administrating the Authority (i.e., PRASA) the way it has been done until now, he said. Ultimately, Puerto Rico severed its relationship with Vivendi, ending the contract.

[For more information on Vivendi's contracts and track record, click here]

To be sure, Vivendi Universal and Accenture are just two corporate members of the USCSI companies involved in the privatization of public services. To name only a few others, EDS is active in the privatization of government services, UPS is using international trade rules to challenge public postal services in many countries (including Canada and Germany), General Electric in active in energy privatization projects, and the members of the National Committee on International Trade in Education (NCITE) are looking for access to the national education sectors of countries around the world. These corporations and many others on the USCSI are eagerly looking for opportunities within the GATS and other international trade and investment agreements to open up opportunities for them to privately provide what have traditionally been public services. And they use the connections and collective leverage of the CSI to do so.

IV. Public Financing: USCSI members and the World Bank & International Monetary Fund (IMF)

International Monetary Fund and World Bank loans always come at a price. IMF loans to 'stabilize' financial markets charge the high price of privatization of core services and massive reduction in social program spending. World Bank loans are also usually made for massive privatization projects. And corporations usually reap the benefits, gaining the newly privatized contracts, and often receiving investment finance from the World Bank. And these are not just side benefits that corporations gain from the IMF and World Bank - in reality, both forced privatization and financing corporate takeovers are at the core of the IMF and World Bank mission in these countries. The national water system of Cameroon stands as a typical example. A joint mission of the IMF and World Bank pressured the government of Cameroon to accelerate the privatization of the state water company Socit nationale des eaux du Cameroun (SNEC) as a condition of an IMF loan policy for Cameroon. The water company Suez, a member of the USCSI's European counterpart lobby group called the European Services Forum, took over the Cameroon governments 51% stake and gained a concession to operate their water supply for a 20-year period. Other examples include:

Vivendi Universal and the World Bank

Vivendi has gained numerous privatization contracts that were initially set up by the World Bank. Vivendi was awarded a EUR 150m renewable lease contract to provide water services for the entire country of Niger, following a World Bank-sponsored international tendering procedure. This was a ten year renewable contract and the World Bank provided most of a 35 million Euro investment finance package. Vivendi was also awarded a 5-year support and service contract in Burkina Faso, again supported by World Bank financing. The contract covers the management of customer service and finance activities and aims to support a program that will lead to the opening of the Ziga dam. And the tendering process for the Nairobi contract discussed earlierhad been conducted by the World Bank. The list of such World Bank help in Vivendi contracts goes on and on.

Citigroup, JP Morgan, the IMF and Brazil

An August 2002 IMF loan to Brazil provides an excellent example of the gains that are made by multinationals, especially banks, when IMF loans are announced. In this case, USCSI members Citigroup and JP Morgan (as well as Fleet Boston), which have enormous investments in Brazil (for example, Citigroup has $9.7 billion in assets there), were on the hook as the Brazilian economy was acing a potential collapse and a default on its debt, much of which was Citigroup and JP Morgan debt. Consequently, the IMF came to the 'rescue' and offered Brazil a $30 billion loan. Not coincidentally, Citigroup and JP Morgan stock value soared immediately after this announcement, because investors knew the potential debt default had been averted and that IMF money would essentially flow back to Citigroup and JP Morgan as payback on their investments. And, of course, as always, Brazil is forced to follow an austerity program that requires privatizing and gutting social programs in order to cut costs and save money to pay back its IMF loan. What this amounted too, essentially, was 'structural adjustment' of the Brazilian economy in order to pay back the likes Citigroup and JP Morgan - the poor paying with the erosion of their public services and their already weak social programs in order to ensure that the investments of billion dollar companies will not be hurt. Thus, the people of Brazil face massive erosion of public services in order to pay back financiers like Citigroup and JP Morgan - under terms and conditions not of their choosing.

It has been argued (half jokingly) by some that IMF money should be sent directly from Washington, D.C. to New York, rather to a country like Brazil first, as most of that money is heading to New York and other international financial centers anyway. It would likely save on transaction costs and would be a more honest portrayal of the workings of the IMF! This case of Citigroup and JP Morgan only adds to the weight of this argument.

Conclusion

As was stated in the introduction, you can almost pick at random from the USCSI membership to find a corporation that is either privatizing public services, embroiled in financial controversy, or gaining from the misery imposed by an IMF loan. There is no other group where the convergence of all of these is as pronounced as it is in the members of the USCSI and this is what makes the USCSI such a key organization in the struggle to understand who is behind the waves of both privatization and scandal that have been hallmarks of the past number of years. If you are trying to understand what is behind the push for corporate friendly trade agreements, for privatization of vital public services, and what the track record of these groups really is, just think of the corporate scandals of 2002 and then think of the attempt to privatize your local water or energy supply, and then think of membership of the U.S. Coalition of Service Industries.

Darren Puscas is researcher at the Polaris Institutein Canada.

|

|

|

|

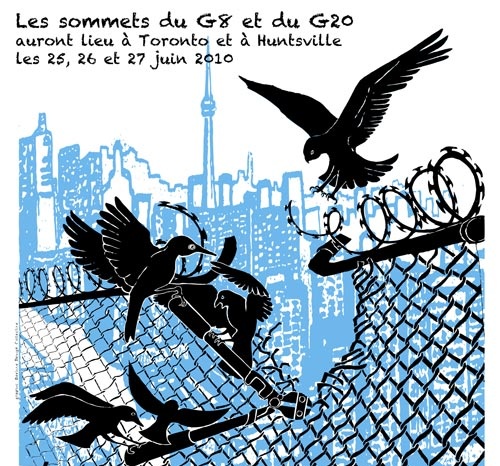

G20 Especial |  |

|

|

|

|

|

|

|

Ofrecemos varios informes independientes y testimonios ...

Lista de acciones durante el 'contracumbre' a Toronto! Algunos medios independientes en Toronto G20 Centro de medios alternativos http://2010.mediacoop.ca Media Co-op Toronto http://toronto.mediacoop.ca Toronto Community Mobilization www.attacktheroots.net (en Inglés) |

|

|

|

|

|

|

|

CMAQ: Vie associative |  |

|

|

|

|

|

|

|

Collectif à Québec: n'existe plus. Impliquez-vous ! |

|

|

|

|

|

|

|

|

|

|

|

|

Ceci est un média alternatif de publication ouverte. Le collectif CMAQ, qui gère la validation des contributions sur le Indymedia-Québec, n'endosse aucunement les propos et ne juge pas de la véracité des informations. Ce sont les commentaires des Internautes, comme vous, qui servent à évaluer la qualité de l'information. Nous avons néanmoins une

Politique éditoriale

, qui essentiellement demande que les contributions portent sur une question d'émancipation et ne proviennent pas de médias commerciaux.

This is an alternative media using open publishing. The CMAQ collective, who validates the posts submitted on the Indymedia-Quebec, does not endorse in any way the opinions and statements and does not judge if the information is correct or true. The quality of the information is evaluated by the comments from Internet surfers, like yourself. We nonetheless have an

Editorial Policy

, which essentially requires that posts be related to questions of emancipation and does not come from a commercial media.