|

|

|

|

|

|

|

|

|

|

|

|

|

|

Régions du Québec |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rubriques |  |

|

|

|

|

|

|

|

|

|

|

|

World Bank Policy on Information Disclosure

Dear World Social Forum participant,

Over 250 civil society organizations from more than 75 countries have endorsed the "Global Call for Greater Transparency at the World Bank" (available on our website in Portuguese, Spanish, French, Russian and Slovakian, http://www.bicusa.org/action). We hope that your organization will add its name to the hundreds of others around the world. We need to send a clear message to the Bank that if it continues to operate in secrecy its legitimacy will increasingly be questioned.

Dear World Social Forum participant,

Over 250 civil society organizations from more than 75 countries have endorsed the "Global Call for Greater Transparency at the World Bank" (available on our website in Portuguese, Spanish, French, Russian and Slovakian, http://www.bicusa.org/action). We hope that your organization will add its name to the hundreds of others around the world. We need to send a clear message to the Bank that if it continues to operate in secrecy its legitimacy will increasingly be questioned.

The Bank is currently reviewing its Policy on Information Disclosure and this provides an opportunity to push for greater transparency. Since your organization will be represented at the World Social Forum, where this topic will be discussed in more detail, we appeal to you to endorse the "Global Call for Greater Transparency at the World Bank."

Below is an English version of the "Global Call", but we have translations in Portuguese, Spanish, French, Russian and Slovakian on our website. For more information about this issue, see our website :

(http://www.bicusa.org/action).

I'm looking forward to hearing from you,

Bryan Hantman

The Bank Information Center (BIC) is an independent, non-profit, non-governmental organization that provides information and strategic support to NGOs and social movements throughout the world on the projects, policies and practices of the World Bank and other Multilateral Development Banks (MDBs).

*****************************************

To endorse this letter, please send a message to Graham Saul, Bank Information Center:, Fax: 1-202-737-1155. Please include: (i) name of the organization endorsing; (ii) name of the person endorsing on behalf of the organization; and (iii) country.

GLOBAL CALL FOR GREATER TRANSPARENCY AT THE WORLD BANK

Ms. Joanne Salop

Vice President

Operations Policy

1818 H Street N.W.

Washington D.C. 20008

Dear Ms. Salop,

We are writing to express our support for transparency in the largest development institution in the world and to express our concerns about the World Bank's proposed information disclosure policy. The World Bank’s increasing emphasis on participation and ‘ownership’ in the past few years is a welcome acknowledgement of the central role that development must accord to the very people whose economic lives are to be developed. We believe that the Bank’s information policy must reflect commitment to and trust in the principles and promises of full popular participation.

A fundamental norm of participation, partnership and ownership is consent of the partners and those invited to participate. Consent is meaningless unless it is informed. At the World Bank, the information disclosure policy is the single most effective enabler toward development effectiveness and partnership goals. We believe there is a direct relationship between the implementation of the information disclosure policy and the ability and willingness of the public to be engaged in Bank activities. Furthermore, the information disclosure policy has allowed interested members of the public to monitor the outcomes of specific investments and has in part helped to assure that benefits reach the intended beneficiaries.

In this new century, and with the accelerated pace of globalization the IDA Deputies and the G7 have recognized the need for more transparency at the international level. While it was not entirely voluntary, the Bank is to be commended for taking a first step toward transparency at the international level through this review of the 1993 information disclosure policy. With modern technology and an accelerated pace of change affecting even the most remote communities, information is one of the very few tools available to the poor and the public at large that allows civil society to both understand and prepare for change. Transparency is an empowerment tool for the poor.

The draft information disclosure policy moves toward greater disclosure and as such is welcomed. There are, however, crippling limitations to the policy that must be addressed if the Bank is to foster an inclusive development model and achieve greater development effectiveness. In its current form, the policy falls far short of enabling partnership and participation. Whole categories of important information continue to be withheld from the public, including all information pertaining to structural adjustment and sectoral adjustment loans the lending that currently makes up the bulk of the Bank’s portfolio. Disappointingly, within the policy it appears that the Board of Executive Directors is not prepared to embrace basic good governance practices that begin with information disclosure. With this letter we argue for the release of:

-all Country Assistance Strategies;

the President’s Report, Tranche Release Memorandum and project documentation relating to structural adjustment and sectoral adjustment;

-aide memoires, project status reports, policy papers and country policy and institutional assessments;

-Board Minutes or the summaries of Board discussions that relate to project and adjustment lending.

Limitations in the New Policy

The World Bank continues to withhold some Country Assistance Strategies from the public even though the public is increasingly asked both to participate in the development of this strategy and work with the Bank in its implementation. The inconsistency in this process should be rectified. Development is not an exclusive process, but requires multiple stakeholders to be engaged in order to be successful. The World Bank cannot expect support from donors, the poor, other development agencies or even broad borrowing country governmental support if its basic strategy for development success is not made known to the public. Currently there are two sets of standards: an open and transparent standard for poor countries and a closed and secret standard for middle income countries. We are aware of the concerns expressed by many countries regarding the availability of the CAS. The CAS, however, according to your own website, is a Bank owned document. As such, it is both the right and the responsibility of the World Bank to disclose this document. Failure to disclose the overall plan for the Bank's operations in any given country mocks the presumption in favor of disclosure that underpins the information disclosure policy.

Macroeconomic Information

We are deeply disappointed by the lack of progress on disclosing documents relating to structural adjustment lending. The current proposal will simply affirm existing practice of allowing a country to make information available at its own discretion.

In Fiscal Year 1999, 63% of the World Bank’s lending operations consisted of policy-based lending (such as structural or sectoral adjustment lending). No documentation has been made available to illuminate the goals, the implementation or the outcomes of these loans. Under the proposed information policy the public will continue to be effectively excluded from participation in the bulk of the World Bank’s lending operations.

Popular participation is increasingly seen as an effective way in which to foster ownership within a borrowing country. Without the basic documentation, citizens cannot be expected to participate in the development, implementation or monitoring of these lending operations.

Structural adjustment is viewed as one of the key ways in which the World Bank is engaged in globalization a contested issue that has sparked massive protests around the world. The failure to release material related to structural adjustment will impede the public’s understanding of the Bank and fosters suspicion around the Bank's role in globalization. While the Bank has attempted to rectify the lack of openness on SAPs with a consultative process for the creation of the Poverty Reduction Strategy Paper (PRSP), the two remain quite different instruments. One is a broad planning instrument and the other is an actual loan. Without access to the loan process it remains impossible for the public to track the implementation of the broad policy goals outlined in the PRSP.

SAPs are often negotiated in a very narrow discussion that excludes relevant ministries and parliamentarians. Nevertheless, parliaments are often asked to approve the loans without access to the basic documentation and ministries are expected to implement the loans. In 1999, in Brazil, the parliament could only obtain a leaked copy of important information around specific proposed investments. Public decisions undertaken in the absence of full information often fail in the implementation stage in large part because the goals are not fully agreed upon or well understood. The development effectiveness would be greatly enhanced by public debate and broad governmental participation. In order to increase development effectiveness the President’s report, tranche release memorandum and project documentation relating to structural adjustment and sectoral adjustment loans should be released. The half-step outlined in the draft policy would only codify what is now existing practice. More importantly, the proposal blurs the line of responsibility between Bank and Borrower. It places the onus on the borrower to both take a decision about Bank generated documents and to undertake the responsibility for distribution. Again in the case of macroeconomic information, the Bank has made a proposal that is not in line with the presumption in favor of disclosure.

Fostering Participation

Perhaps the most disappointing aspect of the proposed new policy is the argument that many documents cannot be released because disclosure would impede 'the deliberative process.' This argument is unsubstantiated within the policy and contradicts the Bank's espoused goals of participation and partnership. Neither goal can be achieved without timely information disclosure. Disclosure after a decision has been taken does not foster ownership and cannot be expected to satisfy public demands to participate in development decisions. Meaningful "participation" requires access to documents while they are still relevant to the "deliberative process," not AFTER final decisions are made.

The Bank should release aide memoires, project status reports, policy papers and country policy and institutional assessments precisely because they inform the deliberative process.

In its new policy the Bank argues that draft project appraisal documents (PADs) do not need to be released because relevant information is already available through the project information documents (PIDs). This argument does not stand up under close scrutiny. Draft PADs include detailed information that is normally not included in PIDs such as: the results of public consultation (in Category A projects), key performance indicators, project alternatives that have been considered, the value added of Bank support, the effectiveness conditions, technical information such as maps that actually lay out the proposed affected area, and a list of other technical documents produced for the project. Effective stakeholder participation in the project cycle requires that the Bank either release Draft PADs or radically improve and more regularly update the composition of PIDs.

The policy also fails to address the issue of getting information especially project information into the hands of directly affected people. In particular, the policy does not address the issue of translating key documents, including the safeguard policies. The fact that the draft policy identifies ‘excessive cost or logistics’ as a reason for non-disclosure is troubling because it appears to provide an excuse for not getting information into the hands of the most directly concerned.

Governance and the Board

Over the past two years in response to shareholder and public concerns about quality and compliance issues the Bank has created two instruments to help improve both the quality of loans and the compliance rates with safeguard policies. These are the Quality Assurance Group and the Quality and Compliance Unit. The new policy notes that the materials generated from these review units will not be made available to the Board or the public. The very idea that the findings of units that have been established in direct response to shareholder and stakeholder demands are not to be disclosed to the Board or other stakeholders is disturbing. In the new policy, no rationale is given for the non-disclosure of QAG's periodic synthesis reports. There is no excuse for the Bank not to disclose this information.

The findings of these units could be very helpful to the Board in its oversight role as they pinpoint problems in specific investments and in broader areas like monitoring and supervision. Through the Inspection Panel process the Board increasingly is confronted with problems that are also identified through the QAG and QACU. Early Board awareness could lead to more timely solutions and an avoidance of Inspection claims. If these materials were to be released to the public it would also help to improve development effectiveness. The Operations Evaluations Department and your own team have on separate occasions noted that the public spotlight has already proven to be one of the best incentives to persuade Bank personnel to administer projects

more effectively.

Lastly, we are very concerned about the Board’s lack of transparency. The World Bank has determined that good governance is an important component for development effectiveness. One of the defining criteria of good governance is transparency. It is ironic that the Board of Executive Directors would approve a condition for borrowing country governments that it is not willing to embrace in its own operations, i.e. that of transparency. Transparency in the Board would be enhanced by the disclosure of Board Minutes or the summaries of Board discussions that relate to project and adjustment lending, along with the proposed Chairman’s Summaries. It is contradictory for the Board to require and encourage borrowing countries to govern in the sunshine when it continues to labor in the dark.

We appreciate the opportunity to share our view with you. We look forward to a revised policy that fosters transparency and empowerment for the poor.

To endorse this letter, please send a message to Graham Saul, Bank Information Center:

, Fax: 1-202-737-1155. Please include: (i) name of the organization endorsing; (ii) name of the person endorsing on behalf of the organization; and (iii) country.

Bryan Hantman

Program Associate for Asia and Central and Eastern Europe

Bank Information Center

733 15th Street NW, Suite 1126

Washington D.C. 20005 USA

Tel: + 202 624 0634

Fax: + 202 737 1155

bhan...@bicusa.org

The Bank Information Center (BIC) is an independent, non-profit, non-governmental organization that provides information

and strategic support to NGOs and social movements throughout the world on the projects, policies and practices of the

World Bank and other Multilateral Development Banks (MDBs). BIC advocates for greater transparency, accountability

and citizen participation at the MDBs. BIC's mission is to empower citizens in developing countries to influence MDB

financed development projects and policies in a manner that fosters social justice and ecological responsibility. BIC aims

to democratize the International Financial Institutions to ensure citizen participation, information disclosure, full adherence to environmental and social policies and public accountability.

|

|

|

|

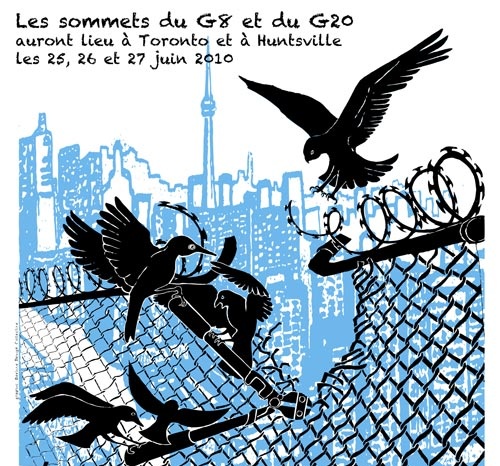

G20 Special |  |

|

|

|

|

|

|

|

We offer many independent reports and testimonies...

List of actions held during this "counter-summit" in Toronto You may also want to visit these alternative media in Toronto: G20 Alternative Media Centre http://2010.mediacoop.ca Media Co-op Toronto http://toronto.mediacoop.ca Toronto Community Mobilization www.attacktheroots.net |

|

|

|

|

|

|

|

CMAQ: Vie associative |  |

|

|

|

|

|

|

|

Quebec City collective: no longer exist. Get involved ! |

|

|

|

|

|

|

|

|

|

|

|

|

Ceci est un média alternatif de publication ouverte. Le collectif CMAQ, qui gère la validation des contributions sur le Indymedia-Québec, n'endosse aucunement les propos et ne juge pas de la véracité des informations. Ce sont les commentaires des Internautes, comme vous, qui servent à évaluer la qualité de l'information. Nous avons néanmoins une

Politique éditoriale

, qui essentiellement demande que les contributions portent sur une question d'émancipation et ne proviennent pas de médias commerciaux.

This is an alternative media using open publishing. The CMAQ collective, who validates the posts submitted on the Indymedia-Quebec, does not endorse in any way the opinions and statements and does not judge if the information is correct or true. The quality of the information is evaluated by the comments from Internet surfers, like yourself. We nonetheless have an

Editorial Policy

, which essentially requires that posts be related to questions of emancipation and does not come from a commercial media.