|

|

|

|

|

|

|

|

|

|

|

|

|

|

Régions du Québec |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rubriques |  |

|

|

|

|

|

|

|

|

|

|

|

Recent Experiences - International Financial Markets

Recent experience with international capital markets suggests that it is not an appropriate time to negotiate a new commercial agreement which would limit signatory countries' abilities to regulate the flow of capital across international boundaries...

Recent Experiences with International Financial Markets: Lessons for the Free Trade Area of the Americas (FTAA)

April 1999

by Mark Weisbrot, co-director of Center for Economic and Policy Research, and Neil Watkins, Research Associate of the Preamble Center

EXECUTIVE SUMMARY

Recent experience with international capital markets suggests that it is not an appropriate time to negotiate a new commercial agreement which would limit signatory countries' abilities to regulate the flow of capital across international boundaries.

But if the investment rules that emerge from negotiations on the Free Trade Area of the Americas (FTAA) are based on investment rules in the North American Free Trade Agreement (NAFTA) and the Multilateral Agreement on Investment (MAI) - as it now appears that they will be - the FTAA would do just that. Provisions in the NAFTA and the MAI on the definition of investment, transfers, and national treatment would severely restrain the ability of governments to regulate even short-term speculative capital flows, in order to prevent or manage a financial crisis.

The recent Asian crisis shows the effects which may result from sudden capital outflows. In East Asia, there was a net reversal of private international capital flows to the region of $105 billion-- from a net inflow of $92.8 billion in 1996 to a net outflow of $12.1 billion in 1997. This amounts to about 11 percent of the GDP, before the crisis, of the combined economies of South Korea, Indonesia, Malaysia, Thailand and the Philippines. This is a massive and highly destabilizing reversal of international capital flows, and it does not appear to be the result of changes in the real, underlying economies of the region.

Financial liberalization measures (often adopted under pressure from the OECD, IMF, or Washington) enacted by many Asian countries in the years prior to the 1997 crash bear much of the responsibility for the region's financial crisis. The result, made worse by IMF austerity measures, was a regional depression, increased unemployment and poverty, and increased political and social tensions that may persist for years to come.

In Mexico, most of the capital inflows in the four year period leading up to the peso crisis were comprised of so-called "hot money" - mainly short-term bank lending and portfolio investment. At the end of 1994 there was a shift in investors' sentiment, resulting in large scale capital flight. In 1995, Mexico experienced a net capital outflow of US $15 billion, as compared to a net inflow of $31 billion in 1993. The impacts of this reversal on the Mexican economy were severe: the economy contracted sharply, unemployment rose, and poverty rates soared.

Some countries have attempted to protect themselves from the harmful effects and instabilities inherent in a world of increasingly unrestricted capital flows. As recent experiences with capital controls in Chile, Colombia, Malaysia, Hong Kong, Taiwan, and China demonstrate, efforts to limit capital mobility are not inconsistent with orderly and robust economic growth and development. To the contrary, using capital controls can be a highly effective strategy in a country's efforts to return to economic growth after a financial crisis, or to prevent excessive short-term international borrowing, for example, from building up in the first place. However, if the deregulatory model (based on the NAFTA and the MAI) for international investment is followed, these and other types of controls would be mostly prohibited by the FTAA.

A number of leading economists have entered the debate over global capital flows and the need for more national controls. Along with Columbia's Jagdish Bhagwati, MIT's Paul Krugman and Harvard's Jeffrey Sachs, World Bank Chief Economist Joseph Stiglitz has repeatedly spoken out about the dangers of further capital account liberalization. Moreover, prominent Latin American economists Manuel Agosin and Ricardo Ffrench-Davis have conducted extensive research into the role of capital flows leading up to the Mexican crisis, and the effectiveness of Chile's capital controls. They argue that governments should adopt "speed bumps," reserve requirements, and other types of capital controls to shield their economies from the destabilizing effects of short-term capital flows.

In short, compelling evidence suggests that it is an inappropriate time to negotiate a treaty that makes it easier for capital to flow uninhibited across national boundaries. But the investment chapter of the proposed Free Trade Area of the Americas (FTAA), if based on the NAFTA/MAI investment model, would accelerate the pace of investment liberalization and capital mobility in the Western Hemisphere. It would restrict the ability of governments to shield themselves from the volatility of global financial markets. At a time when the control of international capital flows is the subject of heightened controversy and debate, the measures currently promoted for inclusion in the FTAA would prohibit most capital controls and similar regulatory measures. Before negotiating any such treaty, we should take stock of the impact of speculative capital flows as well as international capital mobility more generally. It would be unwise and counter-productive to negotiate a treaty that ignores recent experience with deregulated capital flows.

|

|

|

|

G20 Special |  |

|

|

|

|

|

|

|

We offer many independent reports and testimonies...

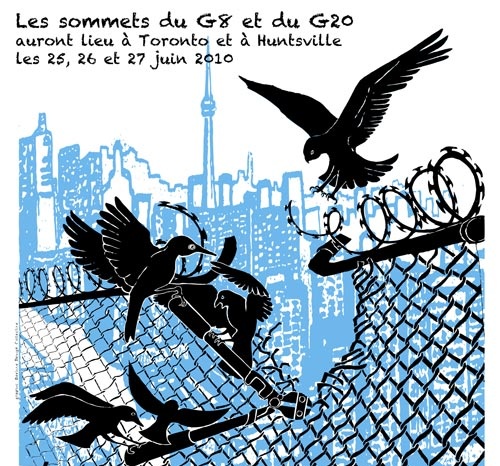

List of actions held during this "counter-summit" in Toronto You may also want to visit these alternative media in Toronto: G20 Alternative Media Centre http://2010.mediacoop.ca Media Co-op Toronto http://toronto.mediacoop.ca Toronto Community Mobilization www.attacktheroots.net |

|

|

|

|

|

|

|

CMAQ: Vie associative |  |

|

|

|

|

|

|

|

Quebec City collective: no longer exist. Get involved ! |

|

|

|

|

|

|

|

|

|

|

|

|

Ceci est un média alternatif de publication ouverte. Le collectif CMAQ, qui gère la validation des contributions sur le Indymedia-Québec, n'endosse aucunement les propos et ne juge pas de la véracité des informations. Ce sont les commentaires des Internautes, comme vous, qui servent à évaluer la qualité de l'information. Nous avons néanmoins une

Politique éditoriale

, qui essentiellement demande que les contributions portent sur une question d'émancipation et ne proviennent pas de médias commerciaux.

This is an alternative media using open publishing. The CMAQ collective, who validates the posts submitted on the Indymedia-Quebec, does not endorse in any way the opinions and statements and does not judge if the information is correct or true. The quality of the information is evaluated by the comments from Internet surfers, like yourself. We nonetheless have an

Editorial Policy

, which essentially requires that posts be related to questions of emancipation and does not come from a commercial media.