|

|

|

|

|

|

|

|

|

|

|

|

|

|

Régions du Québec |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rubriques |  |

|

|

|

|

|

|

|

|

|

|

|

AIG, Congress and the Taxpayers

Why are we continuing to let the government bail out a failing business that is misusing taxpayer money? Surely there are independently owned businesses, and even individuals, that could put that money to far better use.

What is up with AIG? The taxpayers, by way of the government and without being asked, have given AIG more than $122 Billion in funds (the amount is actually said to be more like $152 Billion) to keep the failing insurance giant afloat, and yet AIG cannot seem to tighten its belt. American Insurance Group, a company originally founded in China, has been caught spending hundreds of thousands of dollars in perks for executive, top producers and independent advisor retreats since its taxpayer bailout.

Taxpayers may be aware of the lavish resort visits, but are they being given a choice on whether or not they want to continue funding the irresponsible AIG?

The tab for the first extravagant get-a-way was $440,000. Of that, the expenditures were reported to be $200,000 for rooms, $150,000 for meals $23,000 for spa treatments and $7,000 in Greens fees. So, lets get this straight, they spent all that money to stay in a resort, all that money for food, all that money for spa treatments, and yet there is still $60,000 unaccounted for. Maybe they spent it in tips! Since we are being forced to “help” AIG, I think it only right that we know what happened to the remaining $60,000! And…I am quite sure that with the stress taxpayers are under with regards to our collapsing economy, our losing our homes, our lack of funds to purchase food, we might like a nice get away ourselves, but we cannot afford one.

AIG tried to keep the next big outing secret, even staff members of the resort at which the new outing took place were told not to mention AIG by name. There were no AIG logos or signs to be seen. However, an ABC affiliate caught them on tape. This time, they spent $343,000.

AIG Company spokesperson Nick Ashoon maintains that these “meetings” are essential to their business and success. It is customary, according to Ashoon, to treat top producers and independent producers to retreats. Even AIG CEO Edward Liddy stated that gatherings such as these were “standard practice” in their industry. However, Maryland Representative Elijah Cummings is asking questions, and demanding answers. Cummings suggested, “if AIG truly wants to become as it claims ‘an ethical steward of the public’s investment,’ AIG must change its business practices…and it must…show it is truly willing to be transparent to the public that has saved it.” Cummings states that the first step in that endeavor is to provide him with answers to his requests and for AIG to accept the resignation of newly appointed CEO Liddy.

Liddy, a former Goldman Sachs Director, took over AIG on September 18, 2008 at the appointment of another Goldman Sachs employee, former CEO and now Secretary of Treasury Henry Paulson. Add to this that Neel Kashkari, in charge of dispersing the $700 Billion aid, was also a former Goldman Sachs employee and one must wonder if there is some serious hanky panky going on!

New York State Attorney General Andrew Cuomo has taken a hard-line stance in his approach to AIG. In a letter to Liddy, Cuomo makes it his position clear; there should be no funds paid to AIG executives until the taxpayers are repaid, in full, with interest. He also states that “rebuilding trust in our capital markets requires executive compensation packages that are rational, fair and based on bona fide performance measures…” He goes on to state that these packages should “no longer create improper incentives for executives to over leverage their companies and manipulate the books for their own short-term financial benefit.”

In a letter from Representative Henry Waxman to Liddy, Waxman points out that there were a couple of other “such events.” In light of the fact that AIG is clearly mishandling funds at this point, I must ask again, have the taxpayers been given a chance to say “no” to the bailouts? Have they even been given the opportunity to say to which companies the bailout money should go?

As part of the stipulations for considering approval of the bailout, the White House was supposed to appoint a special inspector general and Congress was supposed to choose an independent oversight panel, all of which has yet to be done, now more than six weeks after the bail out was passed. The purpose of these positions was to avert government waste and corruption. Congress is upset that the White House has not yet appointed the special inspector general, but Congress has failed to appoint the independent committee. Perhaps Senator Charles Schumer said it best when he stated that, “Considering how taxpayers’ money around Washington isn’t respected, a day shouldn’t go by without having an inspector general checking on it…”

To top all of this off, now it appears that the $700 Billion will not be used for the purposes for which it was passed. That’s right. Paulson has decided that a change in direction should be taken. According to a November 12, 2008 New York Times article, Paulson and the Department of Treasury has “abandoned the original strategy behind its $700 billion effort to rescue the financial system” in favor of a lending program run by the Federal Reserve. Now, if that isn’t a scary thought! In addition, Paulson, after demanding that the entire $700 Billion be available at once, has said he may leave half the money for President Elect Obama’s Administration to dole out as they see fit. Paulson, the former CEO, is exhibiting sure signs of a politician as he sold Congress on the bailout using one logic and has now scrapped part of it and is moving in a different direction.

The taxpayers should be up in arms about the disregard with which government, as well as the businesses government has chosen for the taxpayers to “bail out,” has conducted itself. Sure, there are key people in government trying to get things done “properly,” but wouldn’t “properly” have been to let the mis-managed businesses fail and to let other similar businesses pick up the slack? After all, if small businesses, you know the mom and pop businesses that fulfilled the American Dream, fail the government does not run to their aid. If we, as individual citizens fail, we cannot petition government to bail us out. How is it right that big, mis-managed business gets preferential treatment and We-the-People get the shaft? Aren’t We-the People the government? Then again, maybe that is a delusion…

Endnotes:

Another AIG Resort "Junket": Top Execs Caught on Tape 11/10/08

http://abcnews.go.com:80/Blotter/WallStreet/story?id=6223972

AIG Fights Back on $440,000 Resort Trip; Says No Corporate Executives Attended 10/08/08

http://abcnews.go.com/Blotter/story?id=5987363&page=1

$85 Billion Loan to save AIG from Bankruptcy Fed Reserve NY Agreement signed 09/23/08

http://phx.corporate-ir.net/staging/phoenix.zhtml?c=76115&p=irol-newsArt...

After Bailout, AIG Execs Head to California Resort 10/07/08

http://abcnews.go.com/Blotter/story?id=5973452&page=1

AIG's Federal Bailout funds Now Total $152.5 Billion 11/10/08

http://www.findingdulcinea.com/news/business/2008/November/AIG-s-Federal...

Wall Street CEO's Total compensation for 2007

http://www.networkworld.com/slideshows/2008/091808-wall-street-fat-cats....

Letter from Cuomo to Liddy about AIG Compensations

http://abcnews.go.com/images/Blotter/AIG%20Letter%2010%2022%2008.pdf

Letter from Henry Waxman to Liddy

http://www.scribd.com/doc/7112460/House-Oversight-Letter-to-AIGs-Liddy

Liddy's Forbes Profile...Goldman Sachs...

http://people.forbes.com/profile/edward-m-liddy/165

Clayton Dubilier & Rice Edward M Liddy

http://www.cdr-inc.com/index_bio.html

Cummings letter to Liddy

http://abcnews.go.com/images/Blotter/Cummings_to_AIG.pdf

Bailout lacks Oversight Despite Billions Pledged

http://www.washingtonpost.com/wp-dyn/content/article/2008/11/12/AR200811...

U.S. Shifts Focus in Credit Bailout to the Consumer

http://www.nytimes.com:80/2008/11/13/business/economy/13bailout.html?_r=...

Hill sources: Treasury won't use full bailout

http://www.washingtonpost.com/wp-dyn/content/article/2008/11/17/AR200811...

|

|

|

|

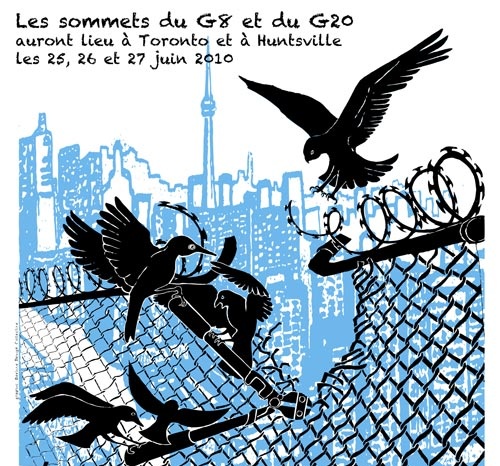

G20 Special |  |

|

|

|

|

|

|

|

We offer many independent reports and testimonies...

List of actions held during this "counter-summit" in Toronto You may also want to visit these alternative media in Toronto: G20 Alternative Media Centre http://2010.mediacoop.ca Media Co-op Toronto http://toronto.mediacoop.ca Toronto Community Mobilization www.attacktheroots.net |

|

|

|

|

|

|

|

CMAQ: Vie associative |  |

|

|

|

|

|

|

|

Quebec City collective: no longer exist. Get involved ! |

|

|

|

|

|

|

|

|

|

|

|

|

Ceci est un média alternatif de publication ouverte. Le collectif CMAQ, qui gère la validation des contributions sur le Indymedia-Québec, n'endosse aucunement les propos et ne juge pas de la véracité des informations. Ce sont les commentaires des Internautes, comme vous, qui servent à évaluer la qualité de l'information. Nous avons néanmoins une

Politique éditoriale

, qui essentiellement demande que les contributions portent sur une question d'émancipation et ne proviennent pas de médias commerciaux.

This is an alternative media using open publishing. The CMAQ collective, who validates the posts submitted on the Indymedia-Quebec, does not endorse in any way the opinions and statements and does not judge if the information is correct or true. The quality of the information is evaluated by the comments from Internet surfers, like yourself. We nonetheless have an

Editorial Policy

, which essentially requires that posts be related to questions of emancipation and does not come from a commercial media.