|

|

|

|

|

|

|

|

|

|

|

|

|

|

Régions du Québec |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rubriques |  |

|

|

|

|

|

|

|

|

|

|

|

Global Depression 2006---? (2900 words)

Assets ain't assets; Taxes ain't taxes; The speculative

motive; Blowing bubbles; The cause of recessions; The

remedy; Self-funding infrastructure; The biggest bubble

in history; The U.S. dollar bubble; Soft on terrorism;

Rogue states; End-game.

GLOBAL DEPRESSION 2006---?

Gavin R. Putland

(http://grputland.com)

December 4, 2005

ASSETS AIN'T ASSETS

One cannot understand economic downturns -- let alone prevent

them -- without understanding certain facts about asset markets.

First of all, one must understand that the assets conventionally

grouped under the heading "means of production" actually fall

into TWO categories:

* Assets that taxpayers can neither create nor destroy nor

move out of the taxing jurisdiction are LAND-LIKE assets.

* The rest -- that is, assets that taxpayers can move and/or

destroy and/or refrain from creating -- may be called (for

want of a better analogy) HOUSE-LIKE assets.

By this terminology, HOUSE-LIKE assets used as means of

production include not only fixed structures, but also

industrial and commercial equipment (fixed or movable) and stock

in trade. The great classical economists from Adam Smith

(1723-1790) to Max Hirsch (1853-1909) called such assets

CAPITAL. Because the production of capital adds to the total

wealth of humanity, and because the PROFITS from capital are an

incentive to produce it, humanity gains from the private

ownership of house-like assets and the private retention of

profits derived therefrom.

LAND-LIKE assets include land (not buildings), other natural

resources (which cannot be created by human effort), and

statutory monopolies and limited licenses (which can be created

only by governments, not by taxpayers). Returns on land-like

assets, net of the demands of labor and capital, are called

ECONOMIC RENT [1]. From the viewpoint of taxpayers, land-like

assets cannot be PRODUCED, but can only be ACQUIRED. Acquiring

an asset that cannot be produced adds nothing to the total

assets of humanity. While the economic rent received from a

land-like asset may be partly contingent on the application of

labor and capital, it accrues to the owner AS OWNER even if the

labor and capital are applied by others, and is therefore not an

incentive to do anything except ACQUIRE the asset. Thus the

argument justifying the private retention of returns on

house-like assets is NOT APPLICABLE to land-like assets.

TAXES AIN'T TAXES

A HOLDING TAX is a periodic tax on ownership of an asset -- in

contrast to a TRANSACTION TAX, which applies to (e.g.) changes

of ownership. All transaction taxes impede commerce. All taxes

on house-like assets reduce the incentive to produce capital.

These effects hinder production and therefore raise prices,

fueling inflation and increasing the dismally-named NATURAL RATE

OF UNEMPLOYMENT, which is the minimum unemployment rate

consistent with non-accelerating inflation. But HOLDING TAXES

ON LAND-LIKE ASSETS have none of these ill effects provided that

the taxes take no more than the economic rent, which is NOT an

incentive for production.

THE SPECULATIVE MOTIVE

An increase in demand for LAND-LIKE assets cannot be offset by

an increase in private production. And indeed the effective

demand for land-like assets tends to increase due to population

growth, economic growth (which increases capacity to pay for the

assets), and provision of infrastructure (which increases the

amenity of certain types of assets, especially land). So

land-like assets tend to appreciate in real terms. This causes

SPECULATIVE DEMAND for land-like assets as individuals and firms

buy assets in the hope of reselling them for higher prices, or

try to save money by early acquisition of assets that they

intend to use later.

BLOWING BUBBLES

In a RATIONAL market, the CAPITALIZED (or "lump-sum") value of a

land-like asset is the DISCOUNTED PRESENT VALUE of the future

rent stream. (That is, the capitalized value is the lump sum

that would yield an interest stream equal to the rent for the

same risk, or the sum of the future rental payments individually

discounted for time and risk.) But speculation tends to make

the market IRRATIONAL. When people see prices rising, they want

to buy into the market. In so doing, they accelerate the rise

in prices, inducing more people to buy in, and so on, causing a

speculative BUBBLE -- that is, a state in which prices are

decoupled from rents and are supported solely by the circular

argument that prices will continue to rise. Eventually the

illusion becomes unsustainable and prices stop rising, taking

away the alleged justification for current prices, and so on:

the bubble BURSTS. But eventually the natural appreciation of

land-like assets leads to a new bubble in the same asset class.

So the market for any land-like asset class is CYCLIC.

THE CAUSE OF RECESSIONS

A bursting bubble in a particular asset market has two

counteracting effects. On the one hand, it drives investors

away from that asset class and, by default, towards some other

asset class that may also be susceptible to bubbles. On the

other hand, those who have invested heavily in the collapsed

market must reduce their expenditure, and some (most likely

those who have bought their assets with borrowed money) become

insolvent. As one agent's expenditure is another's income, and

as one agent's debt is another's asset, a chain reaction ensues,

reducing the funds available for investment in other asset

markets, possibly causing them to collapse, and so on. After an

isolated bubble-burst, the former effect tends to dominate; thus

the land burst of the mid 1920s led to a stock-market bubble [2]

and the stock-market crash of 1987 led to a land bubble. But

when that second bubble bursts, the cumulative belt-tightening

and bad debt tend to cause a recession; thus the stock-market

crash of 1929 led to the Great Depression, and the land burst of

1989 led to the recession of 1990-91.

In short, a burst in one asset market interferes with the cycles

of other markets, sometimes pushing them out of synchronism by

encouraging secondary bubbles, and sometimes drawing them into

synchronism by triggering further bursts (and a recession).

This mutual interference, complicated by external shocks, makes

it difficult to discern the autonomous cycles of some asset

classes, and causes irregularities in cycles that can be more

easily discerned. The clearest cycles are the residential land

cycle (typically 9 years in duration) and the commercial land

cycle (typically 18 years). The exceptional size and unique

importance of the land market mean that a bursting land bubble

is the most reliable SINGLE predictor of a recession [3]; in

particular, the global recessions of 1974-5, 1981-2, and 1990-91

were heralded by bursting "property" bubbles, i.e. land bubbles.

THE REMEDY

To prevent recessions, we must prevent speculative bubbles.

This is done by imposing a sufficiently heavy HOLDING TAX ON

LAND-LIKE ASSETS in lieu of taxes on transactions and house-like

assets. If this holding tax is based on capitalized values or

changes in capitalized values, it reduces the attractiveness of

"capital gains" and forces speculators to consider the tax

implications before bidding up prices. If it is based on

changes in rental values, it directly reduces the changes in

after-tax rents that translate into "capital gains". The

heavier the holding tax, the more productively the owner must

use the asset in order to cover the tax, and the less attractive

it is to hold the asset for PURELY speculative purposes.

SELF-FUNDING INFRASTRUCTURE

To share in the benefit of a public infrastructure project, one

must live or do business in the area served by the

infrastructure, for which purpose one must have access to the

real estate in that area. Hence the economic benefit of the

project is measured by the UPLIFT IN LAND VALUES in that area.

If the benefit exceeds the cost, the cost can be covered by

reclaiming only PART of the benefit through the tax system,

leaving the rest of the benefit as a windfall for property

owners in the affected area, without burdening the taxpayers

outside that area. In this case the windfall does not come at

anyone else's expense, but is part of the overall increase in

human welfare attributable to the project.

Any holding tax based on CAPITALIZED land values indeed reclaims

only PART of the benefit of an infrastructure project. When

such a tax is in place, property owners' tax bills do not

increase unless their land values do, and their land values do

not increase unless, in the judgment of the market, the owners

are better off in spite of the tax. If the tax is based only on

CHANGES in capitalized values, property owners do not lose even

in the initial INTRODUCTION of the tax. The higher the marginal

rate of the tax, the greater the range of public projects that

will pay for themselves through uplifts in land values, hence

the greater the number of projects that will proceed FOR THE

BENEFIT OF PROPERTY OWNERS -- and the faster the rate at which

old taxes can be reduced or abolished, thanks to the surplus

revenue caused by projects whose benefit/cost ratios exceed the

self-funding threshold.

Property owners should therefore welcome land taxation as a

means of investing in public projects that return profits in the

form of SUSTAINABLY higher property values -- not bubbles.

Unfortunately their self-interest has not been so enlightened.

THE BIGGEST BUBBLE IN HISTORY

The first years of the 21st century were marked by a global

property bubble. The inevitable burst began in Australia in

early 2004. It has spread to the British Isles and Europe, and

in due course must reach the United States [4]. Although this

global bubble was confined to "housing" (i.e. residential land),

it was the biggest asset bubble in history in terms of the

combined GDPs of the affected countries [5] -- and that measure

fails to account for the number and economic weight of the

countries involved. The bigger the bubble, the bigger the

burst. The bigger the burst, the bigger the recession.

But even that is understating the problem.

THE U.S. DOLLAR BUBBLE

For half a century the U.S. dollar has been the de facto

international currency. So the growth in international trade

causes growth in the global demand for U.S. dollars, allowing

the U.S. to export dollars -- which cost nothing to produce --

and receive real goods and services in return. That is how the

U.S. manages to import 50 percent more goods and services than

it exports [6]. When the exported dollars are invested, they

can be invested only in U.S. assets, creating a demand for

U.S. Treasury Bills without high interest rates, and inflating

the price/earnings ratios of U.S. property, stocks, bonds and

bills. So the value of the U.S. dollar is out of proportion to

its earning capacity (yields on dollar-denominated assets).

That is one characteristic of a BUBBLE.

The U.S. dollar is also the dominant currency -- and until

November 2000 was the exclusive currency -- for international

trading in oil. Hence the reinvestment of exported dollars in

U.S. assets is sometimes called RECYCLING OF PETRODOLLARS. Any

increase in the global demand for oil or the price of oil causes

a corresponding increase in global demand for the U.S. dollar

and boosts its value, protecting the U.S. economy against the

inflationary effect of higher global oil prices. Such

appreciation of the dollar allows the U.S. to increase its trade

deficit -- and makes U.S. goods and services less competitive,

CAUSING the said increase in the trade deficit.

In 1971 the U.S. dollar ceased to be backed by gold. The U.S.

trade deficit appeared in the late 1970s, increased temporarily

in the mid 1980s, and began its present uncontrolled blowout in

about 1997. These developments made the dollar's position

increasingly dependent on its use in the oil trade, so that the

argument supporting the dollar became increasingly circular:

dollars would buy oil because oil exporters would accept dollars

because dollars would buy other products because exporters of

other products would accept dollars because dollars would buy

oil! Valuation by circular argument is another characteristic

of a BUBBLE.

One thing that could burst the bubble is a credible alternative

to the dollar -- such as the euro.

SOFT ON TERRORISM

In November 2000, Iraq began selling oil for euros instead of

U.S. dollars. The following year, the new U.S. administration

was so busy looking for excuses to attack Iraq that it ignored

multiple warnings about al Qaeda, and was consequently caught

flat-footed on September 11 [7]. When Iraqi oil exports resumed

after the U.S.-led invasion, payments were again in dollars [8].

But this situation will not necessarily continue if U.S. forces

are withdrawn.

ROGUE STATES

Iran expressed interest in the euro from 1999, and had converted

most of its currency reserves to euros by late 2002. In 2003,

Iran began accepting payment in euros for oil exports to Europe

and Asia. In mid 2004, Iran announced that it would establish a

euro-denominated international oil bourse (exchange), which is

now due to start trading by March 2006 [9,10].

Since September 2000, Venezuela and 13 other Latin-American

countries have entered into barter agreements whereby Venezuela

sells oil for goods and services instead of dollars. In mid

2005, Venezuela decided to move its currency reserves out of

U.S. banks and liquidate its investments in U.S. Treasury

securities. By early October, about 60 percent of its reserves

had been converted to euros [11].

In 2004, Syria and Iraq signed a barter agreement whereby Iraq

would supply crude oil in return for refined petroleum products,

without using U.S. dollars [12].

Russia and Norway, on the edge of the Eurozone, have no reason

to keep selling oil exclusively for U.S. dollars. Japan and

China will not keep accumulating dollar reserves forever in

order to finance the ballooning U.S. trade deficit.

END-GAME

Given that the value of the U.S. dollar must fall, nobody wants

to be the last sucker holding dollars. Therefore any perception

that the crash is imminent will trigger selling of dollars in an

effort to pre-empt the crash. That selling will amplify the

perception, causing more selling, and so on; so the perception

will become reality. Worse, the rush to sell dollars will

extend to dollar-denominated assets, including U.S. property,

stocks, bonds and bills. So the burst of the dollar bubble may

be the trigger for the expected burst of the U.S. property

bubble -- among other things.

If, on the contrary, the U.S. property bubble bursts of its own

accord, the falling value of this class of dollar-denominated

assets will reduce the attractiveness of holding dollars.

Worse, the recession precipitated by the property burst will

bring down other dollar-denominated asset markets. If the

initial collapse of the U.S. property market is not enough to

prick the dollar bubble, the ensuing collapse of other

dollar-denominated asset markets will certainly be enough, and

the dollar crash in turn will drive further selling of

dollar-denominated assets.

In either case, there will be a multiple burst involving not

only the global property bubble, which is already deflating

outside the U.S., but also the U.S. dollar bubble and every

other asset bubble that has been pumped up by recycled

petrodollars.

The bigger the burst, the bigger the recession.

----------------------------------------------------------------

NOTES

[1] The so-called "rent" of real property comprises the rent of

the land plus the hire of any building(s) attached to the land;

only the former is economic rent. The so-called "rent" of a

vehicle is not economic rent, but a return on capital.

[2] Most corporate shares are PARTLY backed by land-like assets.

Moreover, the speed with which shares can be traded, relative to

the speed with which they can be created and destroyed, makes

their behavior land-like in the short term.

[3] No person can live, and no business can trade, without

access to land. Moreover, a land bubble tends to be accompanied

by a construction boom (as buyers try to justify the exorbitant

prices paid for sites) and a consumption binge (as owners borrow

against inflated land values to buy goods and services). These

MULTIPLIER EFFECTS work in reverse when the bubble bursts.

Because of the long transaction times in the land market, a

burst is initially manifested as slower sales rather than lower

prices, allowing sellers and their agents to pretend that the

market has "plateaued" when in fact it has crashed. This state

of denial worsens the liquidity crisis that follows the crash.

[4] THE ECONOMIST, November 8, 2005;

http://economist.com/finance/displayStory.cfm?story_id=5132938 .

[5] THE ECONOMIST, June 16, 2005;

http://economist.com/opinion/displayStory.cfm?story_id=4079458 ,

http://economist.com/opinion/displaystory.cfm?story_id=4079027 .

[6] "America's trade deficit with China is 28% higher than

America's total oil import bill... US imports of industrial

supplies, capital goods, automotive vehicles, and consumer goods

all exceed US oil imports." -- Paul Craig Roberts, "Still No

Jobs", COUNTERPUNCH, November 8, 2005,

http://counterpunch.org/roberts11082005.html .

[7] Benjamin DeMott, "Whitewash as Public Service: How the 9/11

Commission Report defrauds the nation", HARPER'S, October 2004,

http://harpers.org/WhitewashAsPublicService.html .

[8] William Clark et al., "U.S. Dollar vs. the Euro: Another

Reason for the Invasion of Iraq", PROJECT CENSORED, #19 for

2002-3, http://projectcensored.org/publications/2004/19.html ;

5 refs.

[9] William Clark et al., "Iran's New Oil Trade System

Challenges U.S. Currency ", PROJECT CENSORED, #9 for 2004-5,

http://projectcensored.org/censored_2006/index.htm#9 ; 5 refs.

[10] Cóilín Nunan, "Petrodollar or Petroeuro? A new source of

global conflict", FEASTA REVIEW No.2,

http://www.feasta.org/documents/review2/nunan.htm ; 32 refs.

[11] Gregory Wilpert, "Venezuela's Central Bank Confirms it

Deposited $20 Billion in Swiss Bank", VENEZUELANALYSIS.COM ,

Oct.5, 2005, http://venezuelanalysis.com/news.php?newsno=1777 .

[12] See e.g. http://www.gasandoil.com/goc/news/ntm43368.htm .

----------------------------------------------------------------

Copyright (c) Prosper Australia (http://prosper.org.au ,

http://earthsharing.org.au , http://lvrg.org.au).

Permission is given to forward, copy, translate, and

otherwise publish this work for non-commercial purposes

provided that the work remains intact and includes this

copyright notice.

|

|

|

|

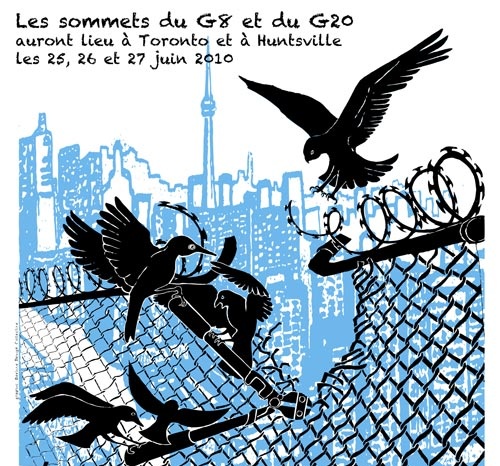

G20 Special |  |

|

|

|

|

|

|

|

We offer many independent reports and testimonies...

List of actions held during this "counter-summit" in Toronto You may also want to visit these alternative media in Toronto: G20 Alternative Media Centre http://2010.mediacoop.ca Media Co-op Toronto http://toronto.mediacoop.ca Toronto Community Mobilization www.attacktheroots.net |

|

|

|

|

|

|

|

CMAQ: Vie associative |  |

|

|

|

|

|

|

|

Quebec City collective: no longer exist. Get involved ! |

|

|

|

|

|

|

|

|

|

|

|

|

Ceci est un média alternatif de publication ouverte. Le collectif CMAQ, qui gère la validation des contributions sur le Indymedia-Québec, n'endosse aucunement les propos et ne juge pas de la véracité des informations. Ce sont les commentaires des Internautes, comme vous, qui servent à évaluer la qualité de l'information. Nous avons néanmoins une

Politique éditoriale

, qui essentiellement demande que les contributions portent sur une question d'émancipation et ne proviennent pas de médias commerciaux.

This is an alternative media using open publishing. The CMAQ collective, who validates the posts submitted on the Indymedia-Quebec, does not endorse in any way the opinions and statements and does not judge if the information is correct or true. The quality of the information is evaluated by the comments from Internet surfers, like yourself. We nonetheless have an

Editorial Policy

, which essentially requires that posts be related to questions of emancipation and does not come from a commercial media.