|

|

|

|

|

|

|

|

|

|

|

|

|

|

Régions du Québec |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rubriques |  |

|

|

|

|

|

|

|

|

|

|

|

World Bank Knew about Enron's Payoffs in Guatemala

The report is a revelation about the shady world of international project finance, a game that Enron perfected hand-in-hand with institutions like the World Bank, and U.S. government agencies like the Overseas Private Investment Bank (OPIC)...

A newly released U.S. Senate report has found that the World Bank and other U.S. taxpayer-backed agencies knew that Enron was paying commissions to a shadowy company called Sun King to win a contract to build a power plant on a barge in Puerto Quetzal, Guatemala, ten years ago.

The bipartisan Senate Finance Committee report, released on Wednesday, including contracts and corporate correspondence, says: "Enron benefited from taxpayer support and multilateral organization support to extend its international reach, including the Guatemalan power project with its questionable payments."

The report is a revelation about the shady world of international project finance, a game that Enron perfected hand-in-hand with institutions like the World Bank, and U.S. government agencies like the Overseas Private Investment Bank (OPIC). Reading between the lines, one can see a lethargic, perhaps negligent, response by these agencies when they were warned of potentially dodgy deals in which they were involved. The Clinton and Bush administrations' preponderance of effort has been in expanding the global operations of favored U.S. corporations.

Today, Enron International still controls this project, and U.S. taxpayer monies are intertwined, through outstanding OPIC and Maritime Administration project finance.

Enron, backed by World Bank and U.S. government money, bought out a publicly-held stake in the power plant in 1993. President Jorge Serrano smoothed the transition. "The Serrano government is a staunch proponent of free market economic policies, and includes privatization as a cornerstone of its platform," reads a 1992 Enron memorandum. The memo requested a $71 million loan from the International Finance Corporation (IFC), the World Bank's private sector arm. The IFC approved the loan in March 1993. OPIC also supported the plant with a $73.8 million political risk insurance package in 1992.

As part of the deal, Enron agreed to pay 6% of the plant's gross revenues to a politically-connected investment group called Sun King. Subsequent events swept Sun King and President Jorge Serrano from the power plant, and power itself.

In 1993, after the Puerto Quetzal plant came on line, Enron started paying tax-free "commissions" to Sun King. According to Enron memoranda contained in the Senate report, Sun King had a relationship with President Serrano that "could prove embarrassing." The same description could be true of the World Bank, OPIC, and Enron's relationships with this project.

One Enron memorandum notes that the "Sun King payments do not represent any REAL [original emphasis] service to Puerto Quetzal Power Corp." Another states that Sun King "talked him [President Serrano] into signing the [privatization] contract. It is the typical 'finder fee' arrangement. As wealthy indviduals that they are, they have the capacity to establish contacts, make pressure, and represent your interest. One of the guys seems to be closer to the army than others, [and] this can be of some benefit if in a given situation if we need to approach the army. [W]e definitely don't want them against our interests if something goes wrong."

The IFC, in reviewing Enron's proposal, apparently knew about the Sun King arrangement, at least according to an Enron memo dated March 12, 1993. That month, the IFC approved a $71 million loan facility. The interoffice memorandum from Ron Teitelbaum notes that "The IFC has objected to PQPC [Puerto Quetzal Power Corporation] paying the commission to SK as this payment has the potential to interfere with PQPC's ability to service the debt owed to the IFC. It is possible to improve this situation if the liability to pay the commission is moved back to PQPC under terms that should be acceptable to the IFC."

President Jorge Serrano then went too far for the Guatemalan public appetite. As the project finance was completed, President Serrano proposed an increase in electricity rates. The price hike, which totaled as much as 100 percent for some customers, were part of the principal complaints of the demonstrators who took to the streets in Guatemala City during the spring of 1993. President Serrano responded to the unrest by declaring martial law, and by attempting to dissolve the Guatemalan Congress. His reach for government-by-decree failed when he was unable to win the support of the military. President Serrano fled the country in May 1993, and the rate increases were suspended. He is currently in exile in Panama.

As long as Serrano was in office, Sun King represented intangible value to Enron. After Serrano was forced to flee, the value of Sun King to Enron eroded. Enron immediately began to discuss buying out the partnership's stake in Puerto Quetzal. A January 1994 memo by Enron employee David Odorizzi explained, Sun King has "fairly low" political influence "and in practical terms, Sunking [sic] seems reluctant to flex any political muscle they have left to help the project." After making nearly $5 million of monthly payments since April 1993, Enron bought out Sun King's interest for $12 million.

This buyout used U.S. taxpayer dollars. The Senate investigation found that "Enron used World Bank funds and funds from U.S. taxpayer supported agencies and lending organizations to finance the Guatemalan power project as well as the questionable payments to Sun King,".

In 1999, the Houston office of the Internal Revenue Service informed the Securities and Exchange Commission and the Department of Justice that Enron "may have violated the Foreign Corrupt Practices Act" in Guatemala.

The SEC and Justice apparently never pursued this any further. Instead, the Clinton and Bush/Cheney administrations continued to grease Enron's global operations.

Enron rose to international heights on the back of public institutions, particularly the U.S. Export-Import Bank, OPIC, and the World Bank. Since 1992, at least 21 agencies, representing the U.S. government, multilateral development banks, and other national governments, helped leverage Enron's global reach by approving $7.2 billion in public financing toward 38 projects in 29 countries.

The company was the darling of these institutions' global energy privatization strategy, first engineered by the Reagan administration's Treasury Department. In 1983, the department called upon the World Bank to end its "socialist drift" toward public energy projects and to instead "remove impediments and adopt policies which foster private sector involvement in energy development."

Treasury continued to champion Enron through the Clinton era. In 1999, just as the IRS was warning the SEC and Justice about Enron's overseas dealings, CEO Kenneth Lay wrote letters reflecting a warm relationship with the out-going and in-coming Secretaries of Treasury.

Exit Robert Rubin: "Although not surprised, I am sorry to see you step down as Treasury Secretary. By any objective or subjective measurement, you have done an outstanding job not only for your country but for the world," crowed Lay. "If you are considering joining any corporate boards, I would like very much to talk to you."

Enter Lawrence Summers: "Congratulations on taking the reins at the Treasury," wrote Lay. "You have certainly had a lot of on the job training with Bob and I have absolutely no doubt that you will do an outstanding job, just as he has done I hope our paths continue to cross and certainly stand ready to be available if there is anything at all I or Enron could do for you or the department."

There was plenty that Treasury officials continued to do for Enron. After the IRS first warned of Enron's potential FCPA violation, Treasury agencies OPIC and ExIm approved even more financing for the corporations' global expansion. OPIC supported a power project in Nigeria, structured very similarly to Puerto Quetzal. In Nigeria, Senator Carl Levin charged last year, "Enron cooked the books." (See CorpWatch link)

In 2001, the World Bank, with no opposition from the Treasury respresentative, backed a $3.3 million guarantee for an Enron power plant in Panama. The financing flowed to an investor in the plant named Lloyds TSB Bank of Panama, a subsidiary of Lloyds (the London-based insurance and banking empire).

One can only assume that MIGA officials did not read the transcript of the Feb. 2001 U.S. Senate investigation on money laundering. One of the banks investigated by Sen. Carl Levin's staff was a Lloyds affiliate named British Bank of Latin America (BBLA), "a small offshore bank that was licensed in the Bahamas but accepted clients only from Colombia. (and) became a conduit for illegal drug money." According to that Senate investigation, BBLA's account statements included "large money transfers" with Lloyd's Panamanian affiliate.

Even after Enron's collapse, the U.S. government remains on the hook for many standing OPIC and ExIm deals with Enron. The Bush/Cheney administration even failed to oppose a new project in which Enron International is a leading player: the expansion of the Transredes gas pipeline system in Bolivia. Last December, the Inter-American Development Bank, in which the U.S. government is the leading investor, approved a $125 million loan for this project.

Here, again, U.S. government and multilateral bank officials have neglected accusations of financial malpractice and corruption. According to Jorge Cortes of the Bolivian NGO, CEADES, a May 2002 investigation by Bolivia's Parliament found that Enron had created a "ghost foundation" used by company staff to buy shares in the Cuiab pipeline, thus increasing its value while defrauding legitimate shareholders. The Bolivian govenrment has also admitted that government officials received $2.5 million dollars from Enron, allegedly for travel expenses, while the public gas pipeline company was being privatized. Further, charges Cortes, the Bolivian President benefits from a secret private gas line leading from the Transredes system to his own gold mine. The mine, in turn, is supported by an IFC investment.

"Corporate corruption controls much of the power in Bolivia and the public interest has been hijacked by private profit," charges Cortes.

As the U.S. Senate investigation reveals, such hijackings are occurring with some knowledge of the federal government and multilateral development banks. The contagion was noted by long-time global anti-corruption activists, traditionally a fairly conservative group, at the 11th International Anti-Corruption Conference, in Seoul, Korea, in May 2003.

Their final communique declared:

"We believe that water and energy resources should be considered public goods, access to which is a fundamental human right... When it appears likely that officials in privatized water or energy utilities may have engaged in corrupt practices, an independent commission should investigate them together with any public agencies - including international financial institutions (IFIs) and export credit agencies - that may have financed the transactions... When international agencies are found to have financed such corrupt transactions, they - not the consumers - must bear appropriate responsibility for outstanding loans and credits.. We recommend that IFIs and donors should end the practice of insisting on privatization as a condition of loans and allow for the consideration of the full range of public and private sector models."

Jim Vallette is research director of the Sustainable Energy and Economy Network, a project of the Institute for Policy Studies. He is co-author, with Daphne Wysham, of SEEN's March 2002 report, "Enron's Pawns: How Public Institutions Bankrolled Enron's Globalization Game," available at: www.seen.org.

|

|

|

|

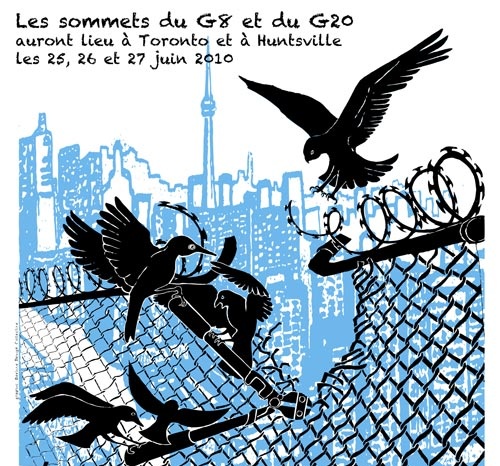

G20 Special |  |

|

|

|

|

|

|

|

We offer many independent reports and testimonies...

List of actions held during this "counter-summit" in Toronto You may also want to visit these alternative media in Toronto: G20 Alternative Media Centre http://2010.mediacoop.ca Media Co-op Toronto http://toronto.mediacoop.ca Toronto Community Mobilization www.attacktheroots.net |

|

|

|

|

|

|

|

CMAQ: Vie associative |  |

|

|

|

|

|

|

|

Quebec City collective: no longer exist. Get involved ! |

|

|

|

|

|

|

|

|

|

|

|

|

Ceci est un média alternatif de publication ouverte. Le collectif CMAQ, qui gère la validation des contributions sur le Indymedia-Québec, n'endosse aucunement les propos et ne juge pas de la véracité des informations. Ce sont les commentaires des Internautes, comme vous, qui servent à évaluer la qualité de l'information. Nous avons néanmoins une

Politique éditoriale

, qui essentiellement demande que les contributions portent sur une question d'émancipation et ne proviennent pas de médias commerciaux.

This is an alternative media using open publishing. The CMAQ collective, who validates the posts submitted on the Indymedia-Quebec, does not endorse in any way the opinions and statements and does not judge if the information is correct or true. The quality of the information is evaluated by the comments from Internet surfers, like yourself. We nonetheless have an

Editorial Policy

, which essentially requires that posts be related to questions of emancipation and does not come from a commercial media.