|

|

|

|

|

|

|

|

|

|

|

|

|

|

Régions du Québec |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rubriques (sujets) |  |

|

|

|

|

|

|

|

|

|

|

|

Prequisities for Overcoming the Financial Crisis

"In analyzing financial crises, real causes should be differentiated from the side-effects. One of the essential causes for the current crisis is the discrepancy between the linear growth of the real economy and the exponential growth of financial management created by the derivative-economy."

PREREQUISITES FOR OVERCOMING THE FINANCIAL CRISIS

What is the real background for the news of an economic upswing?

31 “To what then shall I compare the men of this generation, and what are they like? 32 “They are like children who sit in the market place and call to one another, and they say, ‘We played the flute for you, and you did not dance; we sang a dirge, and you did not weep.’ 33 “For John the Baptist has come eating no bread and drinking no wine, and you say, ‘He has a demon!’ 34 “The Son of Man has come eating and drinking, and you say, ‘Behold, a gluttonous man and a drunkard, a friend of tax collectors and sinners!’ 35 “Yet wisdom is vindicated by all her children.” (Luke 7,31-35)

By Gisbert Otto

[This article published in: Zeit-Fragen 45/46, 11/18/2009 is translated from the German on the Internet, http://www.zeit-fragen.ch/ausgaben/2009/nr4546-vom-18112009/.]

At the beginning of November 2009, Werner Schnappauf declared: “The crash has ended but no sustainable upswing is in sight.”

The “Financial Times of Germany” reported at the end of October that confidence had grown. More investors than before expect rising stock prices up to the spring of 2010. Optimistic news also comes from the US: the US gross domestic product increased 3.5 percent in the third quarter.

This plus is regarded as a sign for the end of the worst recession since the 1930s. But are the crucial economic factors considered in this news? Were essential measures enacted that are necessary for a reversal? For example, are there initiatives for redressing the shocking state debts that all western industrial nations accumulated in bailing out the banks?

Nothing is heard about this even though the annual interests that Germany has to pay for its state debts greatly strain the state budget (total 2008 budget 288.4 billion euro; 2009 compound interests are more than 42 billion euro). One could think that the crash of 2007/2008 that for many was very grievous has fallen into oblivion.

Many market observers see the boom on the stock market as a sign that the crisis after two years is now finally over. But were the causes of the crisis really identified? Do we not witness “business as usual”?

In analyzing financial crises, real causes should be differentiated from the side- effects. One of the essential causes for the current crisis is the discrepancy between the linear growth of the real economy and the exponential growth of financial management created above all by the derivative economy risks that cannot be managed any more. Its extraordinary growth went along with an exponential increase of debts that involved all leading industrial nations. The still non-existent regulations in the worldwide financial markets, the low-interest policy, the bailout programs and the excessive manager bonuses are side effects.

Taken together, these facts have not triggered any incentives to revitalize economies. Rather the gambling casino clearly visible for everyone at the outbreak of the financial crisis is strengthened and not only maintained. However this is not treated as a problem in the general public. Quite the contrary, bailout programs for banks are stylized as necessary and important measures.

BAILOUT OF BANKS (BAD BANKS)

Bailout programs should enable financial institutions to pass high-risk securities to “bad banks” and thereby correct their balance sheets.

The offloading of these securities should free the affected institutions from risks of high losses and force them to rely on their own capital. Banks must cover part of their credit awards with their own capital holdings. A large part of their own capital ensured risky securities. According to estimates, high-risk securities in German bank balance sheets amount to 230 billion euro.

However introduction of “bad banks” does not solve the problem. They do not reduce the debts but only shift the debts to another account, the state account. Taxpayers will be saddled with them. Therefore bailout programs do not end the crisis but bring about the opposite. They intensify the depressive tendencies in the economy. As a result, the next crisis will be even more dramatic than the last. Banks are reserved in awarding credits to the economy today. As long as money is hoarded by banks and the rich and does not flow as investments in the real economy, a system built on debts cannot be renewed. Only the moment of its collapse is delayed.

REDRESSING IMBALANCES

Money has become the language of the neoliberal society. Therefore it is no wonder that many bankers and economists have completely lost any relation to the real economy.

Nevertheless the future of the social market economy is only in the real economy and is a prerequisite for the creation of prosperity. The derivative economy based on debts cannot achieve this but threatens the prosperity of the majority of people.

For industrial nations to regain their old strength, the problem of extremely unequal assets distribution must be solved, not only the production problem. A bailout of banks at the expense of taxpayers brings about the exact opposite. Asset inequality is increased instead of being driven back. That the banks bailed ou9t with state funds are pouring out bonuses in the billions is also detrimental. The question presses whether those who inflicted a catastrophe like the banking- and financial crisis can morally pay out such bonuses. Obviously they did not know the causes of the crisis, did not want to know them or were simply elitist and only focused on their self-interest. Must we not speak here of a moral degeneration of a whole generation?

Every crisis has the potential of a new beginning. We could ponder a supportive principle of economic life, the principle of good faith, which we must revive. This principle is a term of jurisprudence. “Good faith” describes the conduct of an honest respectable actor. This principle must also be in effect for the banks. Banks should strengthen the real economy through credits and help finance innovation and not try to make profits with speculative investments.

BASIC REFORMS ARE NECESSARY

Basic reforms are obviously needed to induce an about-face in the economy. The “winner euphoria” of capitalism that intensified through the collapse of the Soviet economy system does not correspond to the real demands urged 30 years ago. Up to 1975, for example, the wages of employees and the profits of businesses increased in the European Union. Domestic demand – alongside export – was the motor of a strong economy. Today domestic demand is weak. Germany has almost 8 million Hartz IV recipients.

The grave system crisis that we experience today can only be solved by striving for an economic form that allows the rise of real wages and does not impose more and more jobs on people to ensure survival. We find initiatives for this with cooperatives and with the research work over years by Elinor Ostrom who was awarded the Nobel Prize for Economics in 2009.

A COOPERATIVELY ORGANIZED ECONOMIC SYSTEM

One central idea of cooperatives is that every member has the same voting right of one vote. All members have equal rights irrespective of the amount of their capital contribution.

Thus cooperatives have firmly anchored the principle of good faith in their form of work and production. This model is in crass contrast to today’s neoliberal economy in which financial elites and multinational corporations decide over people and governments. Cooperatives work again undermining democratic structures. On the basis of their form of work, namely the voting equality of all members, they can contribute to democratizing the economy and realizing the basic right to self-determination in businesses.

THE EMPIRICAL RESULTS OF ELINOR OSTROM’S RESEARCH

With her empirical fieldwork, Elinor Ostrom found a way between the “free market” and the “state economy.” The former claims the person by nature is selfish and the common good is assured when everyone can live out his drives on a “free market.” The other pleads for state rules, interventions and investments.

The crisis has shown that the unbridled ideology of the “free market” ends in a catastrophe. The subsequent reaction of the state has led to enormous debt mountains. However nothing has fundamentally changed. In countless field studies, Elinor Ostrom discovered people can work together very well. She also encouraged the principle of good faith. People all over the world can deal with common property – even without the market and without the state – so all sides can share in the proceeds. Elinor Ostrom drew three important conclusions:

· A person is a social being and is not only determined by economic rationality.

· In many cases, cooperation is better than competition.

· There are no great global solutions but innumerable local solutions.

In her book “Governing the Commons,” Elinor Ostrom describes how Swiss farmers protect their Alps meadows from over-exploitation through non-governmental institutions.

Swiss farmers agree on rules of use and elect their monitoring “boards,” which are empowered by the concerned themselves and have no state authority. Analogous examples from Japan show people react successfully to similar problems with structurally similar rules that are different in detail.

Ostrom did not reach these conclusions yesterday. Her major work “Governing the Commons” was published in 1990. But her discoveries were hardly noticed or taken seriously by global politicians in the past. This is now changing since developments begin with individual persons.

RELATED LINKS

The economy should be a part of life, not a steamroller crushing creativity and self-determination. Shriveling the financial sector is vital for a future with generalized security and environmental caring.

"The Corporation," "Manufacturing Consent," "The American Ruling Class" and "American Casino" could lead us out of the dystopia of trickle-down economics and the self-healing market.

The state has a social nature and cannot only be a power and security state. The market is a tool helpful after political questions are answered: What kind of society do we want? How can the commons be shared? Are we citizens or only consumers? The economy of enough could supersede the economy of generalized insecurity, non-stop minority consumerism and "financial innovations."

"The American Ruling Class"

http://www.snagfilms.com/films/title/american_ruling_class/

"American Casino" http://www.americancasinothemovie.com

"The Corporation"

http://www.hulu.com/watch/118169/the-corporation

"Manufacturing Consent"

http://www.hulu.com/watch/118171/manufacturing-consent

VIDEO: Dean Baker and John Nichols on GRITtvChanging the Jobs Debate

http://lauraflanders.firedoglake.com/?p=2865

Steven Lendman: “The Recession is Over, the Depression is Just Beginning”

http://www.indybay.org/newsitems/2010/01/11/18634971.php

Danny Schechter: Plunder

http://therealnews.com/t2/index.php?option=com_content&task=view&id=31&I...

Joseph Stiglitz: Harsh lessons we may need to learn again

http://www.chinadaily.com.cn/opinion/2009-12/31/content_9249981.htm

|

|

|

|

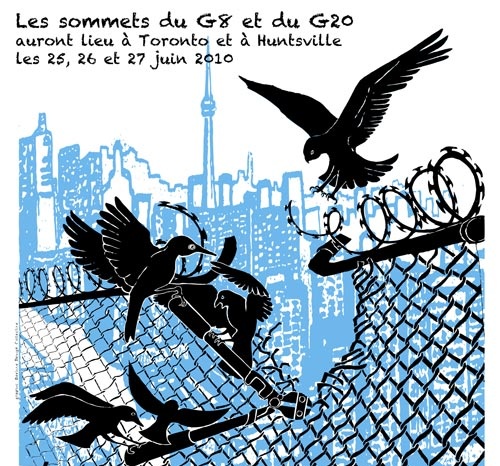

Dossier G20 |  |

|

|

|

|

|

|

|

Nous vous offrons plusieurs reportages indépendants et témoignages...

Liste des activités lors de ce « contre-sommet » à Toronto Vous pouvez aussi visiter ces médias alternatifs anglophones... Centre des médias Alternatifs Toronto 2010.mediacoop.net Media Co-op Toronto http://toronto.mediacoop.ca Toronto Community Mobilization www.attacktheroots.net (en Anglais) |

|

|

|

|

|

|

|

CMAQ: Vie associative |  |

|

|

|

|

|

|

|

Collectif à Québec: n'existe plus. Impliquez-vous ! |

|

|

|

|

|

|

|

|

|

|

|

|

Ceci est un média alternatif de publication ouverte. Le collectif CMAQ, qui gère la validation des contributions sur le Indymedia-Québec, n'endosse aucunement les propos et ne juge pas de la véracité des informations. Ce sont les commentaires des Internautes, comme vous, qui servent à évaluer la qualité de l'information. Nous avons néanmoins une

Politique éditoriale

, qui essentiellement demande que les contributions portent sur une question d'émancipation et ne proviennent pas de médias commerciaux.

This is an alternative media using open publishing. The CMAQ collective, who validates the posts submitted on the Indymedia-Quebec, does not endorse in any way the opinions and statements and does not judge if the information is correct or true. The quality of the information is evaluated by the comments from Internet surfers, like yourself. We nonetheless have an

Editorial Policy

, which essentially requires that posts be related to questions of emancipation and does not come from a commercial media.